Investors still eying opportunities despite funding winter

Despite the global economy slumping amid inflation and supply chain issues, global venture capitalists are continuing to seek out investment opportunities, albeit more cautiously than before.

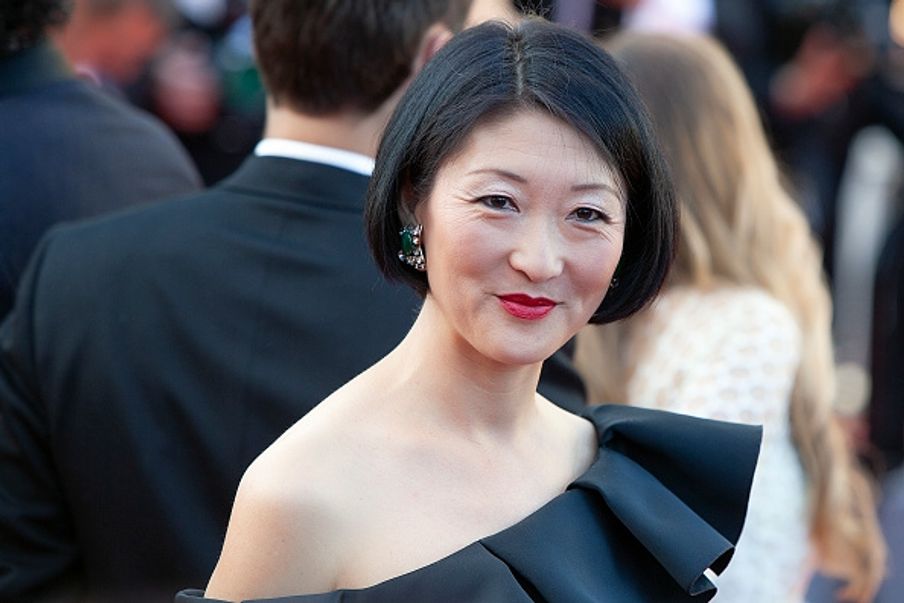

Fleur Pellerin, former French Minister of Small and Medium Companies and the Digital Economy, has become somewhat of a celebrity in the South Korean startup sector, not only because she is a South Korean adoptee who was adopted as a child by French parents who has risen to the upper echelons of French politics, but also for her reputation as an avid entrepreneur and investor working to build bridges between Korean and European markets.

Since becoming a Minister in 2012, Pellerin’s frequent visits to South Korea have garnered domestic attention, especially as many find the story of her adoption and subsequent political success highly inspiring.

During her latest visit to Jeju Island, a popular Korean vacation spot, on Oct. 25, The Miilk was fortunate enough to talk with her about mounting concerns over a global recession and its potential impact on the startup market.

Pellerin, who now heads up the Paris-based venture capital firm Korelya Capital, said she remains upbeat about the global startup and venture capital sectors, despite recent economic slumps caused by rising interest rates and inflation, and the ongoing war between Ukraine and Russia.

“Although I can’t say for certain how long this [economic downturn] will last, the biggest difference between our situation now and former economic crises is that we have a lot of money now, a lot of dry powder to burn through,” Pellerin said in an interview that took place on the island, while participating in an ESG conference.

While discussing global venture capital firms that raised a decent amount of money last year, she explained “It’s just that investors are more cautious than before; there’s still money to invest.”

After she stepped down as the French Minister of Culture in 2016, she co-founded Korelya with former French financier Antoine Dresch. Backed by Korean internet giant Naver, which has sunk €200 million into the investment fund Pellerin has used the fund to back European startups, such as the high-end audio speaker manufacturer Devialet and recruitment platform Jobteaser.

In 2017, Korelya led the $13 million Series A round for the AI voice-recognition platform Snips, which was later acquired by US audio system manufacturer Sonos for $37.5 million.

Challenges and Opportunities

Especially against the backdrop of the ongoing economic crunch that has hampered businesses globally, Pellerin said she felt “lucky” that her company’s portfolio was well-financed prior to the current crisis.

“The companies who are really struggling are those that have needed to raise new funds since last December. So many investors are in wait-and-see mode at the moment,” she said.

According to the now-CEO, although the financial slowdown will inevitably be a tough period for some, it also presents an unparalleled opportunity to investors, as startup valuations drop. Given the reserves of cash held by many investment firms, Pellerin remains optimistic.

The biggest factor hampering investors’ willingness to take a punt on riskier ventures is the escalation of tensions between the US and China, she added. “The biggest uncertainty is how the relationship between China and the US will develop, and its consequent impact on the world economy, in terms of global supply chains, regionalization, and progress towards deglobalization,” Pellerin said.

The Importance of Soft Power

In the coming years, Pellering anticipates that Korea’s startup market and investment sector will profit extensively from the global waves created by its cultural content, which is often referred to as soft power.

Korean film, music and TV, such as Squid Game and BTS, have gained global acclaim, raking in prestigious awards and accolades.

“This is precisely the right moment for the nation to leverage its cultural powerpower by expanding into France and Europe,” she said.

The Korean startup market is already seeing a positive spillover effect from the success of its cultural sector, as global players continue to give increased attention to Korean startups.

To give an example, in 2021, the German delivery firm Delivery Hero took over the Korean delivery platform operator Woowa Brothers in a $4 billion deal.

As of July this year, the number of Korean startup unicorns valued at 1 trillion won ($701 million) or more surpassed 23, according to an announcement from the Ministry of SMEs and Startups, which cited market reports by research firms such as d by research firm CB Insights. This marks an increase of 10 from the 13 unicorns recorded in late 2020.

“The success stories of the FinTech firm Toss and Woowa Brothers will inspire the next generation of entrepreneurs, whether they seek to expand their startups into unicorns or sell them off to foreign investors,” Pellerin said.

Although Korelya has only invested in European companies so far, it plans to add a Korean strand to its portfolio in the future.

“We bring to the table not only money but also our network in Europe, which would be of particular relevance to startups that plan to expand their businesses, seek out new partners, or gather capital in Europe,” said the politician-turned-entrepreneur, emphasizing the importance of studying target markets and finding reliable partners that can offer invaluable market insights. Korelya aims to provide all that and more to the companies within its portfolio.

Youngwon Kim (youngwon@themiilk.com) wrote this article, based on the interview carried out by Jaekwon Son(jaekwon@themiilk.com) with Fleur Pellerin on Oct. 25 in Jeju Island. It was edited by Moorea Mehta (m.p.a.mehta@gmail.com).